Spend less fundamentally

What's in this article...

Home ownership function saving extra cash over time. In some instances, the expense of a month-to-month mortgage repayment tends to be below the expense of a rental fee. It’s not necessary to rent additional space otherwise challenge having vehicle parking of your house, both.

You will never experience increased lease money, as well. A property owner can be ratchet right up leasing costs whenever they need certainly to. However with a home loan, you have a clearer sense of debt picture on days ahead.

Obtain Tax Write-offs

You will need to shell out taxes once you graduate to your genuine community and land employment. A critical benefit of home ownership is deducting mortgage notice whenever completing your efficiency.

On your own first 12 months of homeownership, you’ll be able to manage to subtract portions of closing can cost you. Feel free to claim origination charges, being found in closing costs. And for yet another benefit, you could potentially subtract your property taxes.

Whenever wishing to purchase property, you need to start with a very clear funds. Look at the month-to-month paycheck and produce a network to maximize savings. Regardless if you are graduating off a community university otherwise one out of an excellent different county, a number of the rules of getting property are the same anyplace you adore. A lot of us move around in just after university, thus you should discover a place to real time.

Hammer Aside a budget

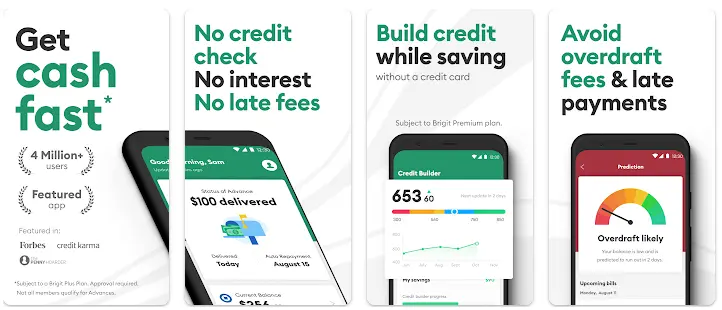

Thought a funds setting looking for an easy way to alive inside your mode. Contemplate using an app otherwise spreadsheet to track your own expenditures per month. Make up tools, rent or mortgage repayments, registration charge, cable, student loans, and much more.

Endeavor to limit 29% of revenues so you’re able to construction will cost you. This means that, while you are taking-in $step three,000 from work 30 days, keep the book or mortgage less than $step one,000 30 days.

Take the appropriate steps to place Profit Deals

If you find yourself new regarding college, coping with family or a roommate for a time tends to be advantageous to build up deals. https://paydayloansconnecticut.com/pemberwick/ You might pouch more of your own paycheck once you lack to expend rent or a mortgage.

You don’t have to generate ramen your go-in order to buffet, however, feel frugal. Restrict your spending on dining, video clips, or any other low-important products.

Query Friends for Assist

This new down payment can be the most significant challenge when a recently available university scholar buys a property. You have got below tens and thousands of bucks when you look at the your checking account. And you also won’t have profited about profit away from an earlier family.

Consider looking at your family getting assistance with a down payment. Your parents are ready to make you currency. For folks who wade it station, you will need to manage your lender to verify a number of anything basic.

Your own financial will need proof the partnership. They’re going to in addition need something special page guaranteeing your own parents’ intention to help you supply the money. On the other hand, your own bank may want to come across a great banknote and other sign of your money’s origin.

eight. Understand the Role of Credit score

When you decide to follow homeownership, you should have a less complicated date that have a better credit history. Loan providers will look at the credit score when they dictate an effective loan amount. There are ways to improve your get upfront speaking which have lenders.

What is a credit rating?

A credit history selections away from 300 to 850, providing individuals a sense of the creditworthiness. The greater the amount, the better this new score.

A credit history uses an algorithm one considers facts like your vehicles, mastercard, or student loan financial obligation. It will also cause of expenses costs, discover profile, and you will offered credit.